In 2025, credit unions across the United States stand at the crossroads of survival and collapse in the face of unprecedented cybersecurity challenges. Sophisticated cyber threats, intense regulatory scrutiny, and limited financial and human resources have converged into a crisis that could redefine the credit union movement itself. To explore detailed insights of Credit Union Cybersecurity Crisis 2025 : Strategic Analysis & The Seceon Platform Imperative , read the full whitepaper. Serving over 135 million members, these community financial institutions must urgently transition from reactive security postures to proactive, AI-driven defense models. This whitepaper provides an in-depth assessment of the current cybersecurity landscape, identifies the structural weaknesses of credit union security operations, and presents the Seceon Platform as a transformative, scalable, and affordable cybersecurity framework.

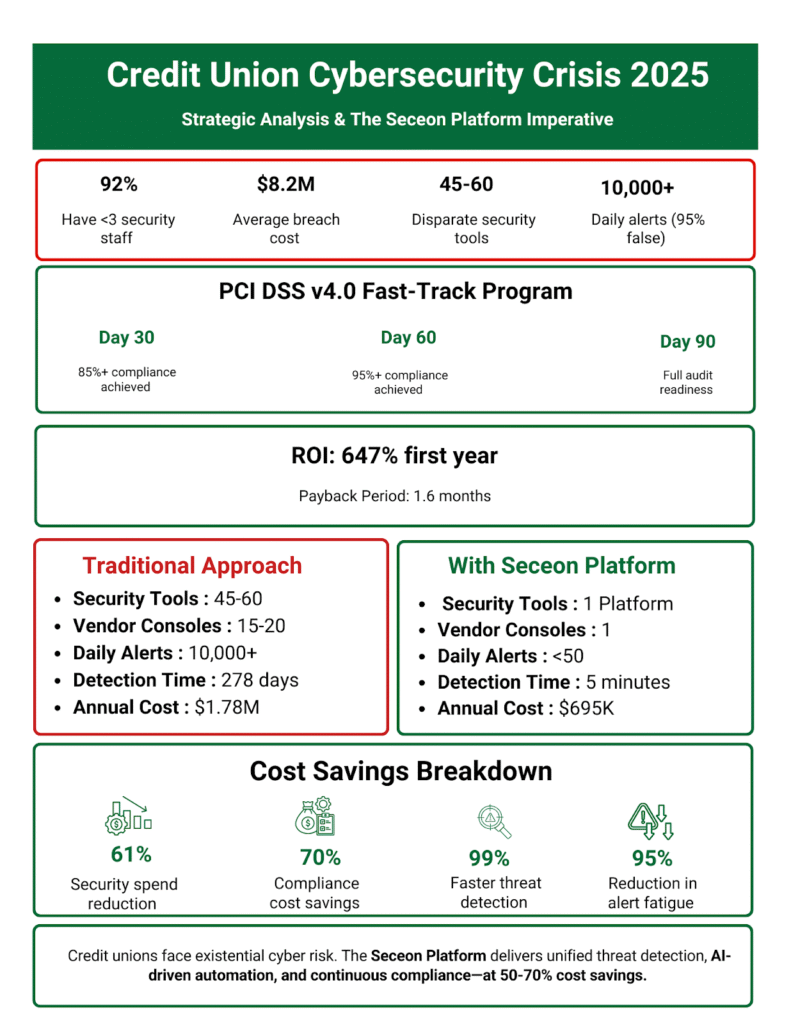

These indicators reveal a sector under siege. While large commercial banks invest millions in dedicated security operations centers (SOCs), smaller credit unions rely on fragmented security tools, shared services, and part-time IT teams ill-equipped for today’s advanced threats.

Current State Analysis:

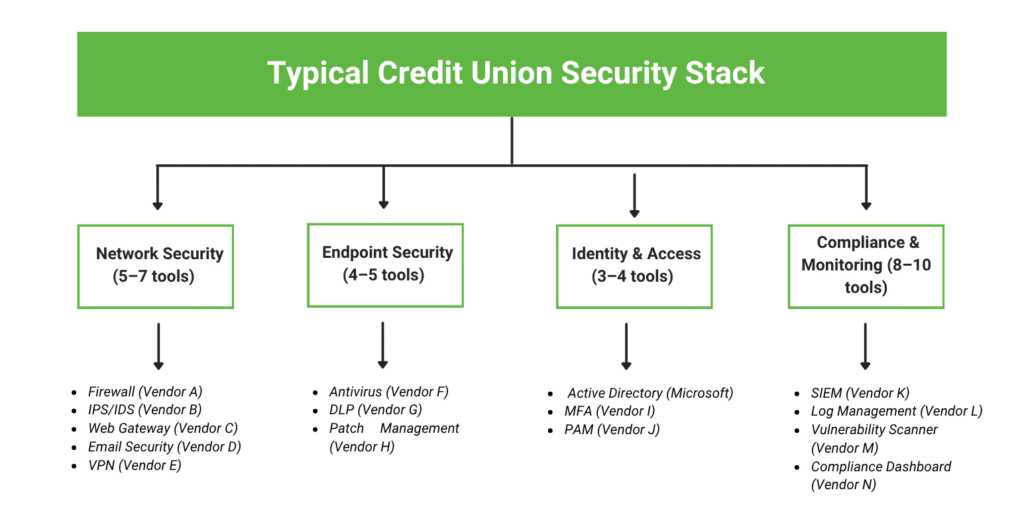

The modern credit union security stack resembles a patchwork of unintegrated systems — from network firewalls to endpoint defenses and compliance dashboards. The result is a disjointed operational structure where visibility gaps multiply risk.

Impact Example:

The 2024 MGM Grand Casino breach showed how disjointed security tools create fatal blind spots. Despite using 76 tools, attackers easily exploited the gap between endpoint and identity systems, costing $100M+. Credit unions face the same structural weaknesses.

Bottom Line: Siloed tools are not security, they are liabilities.

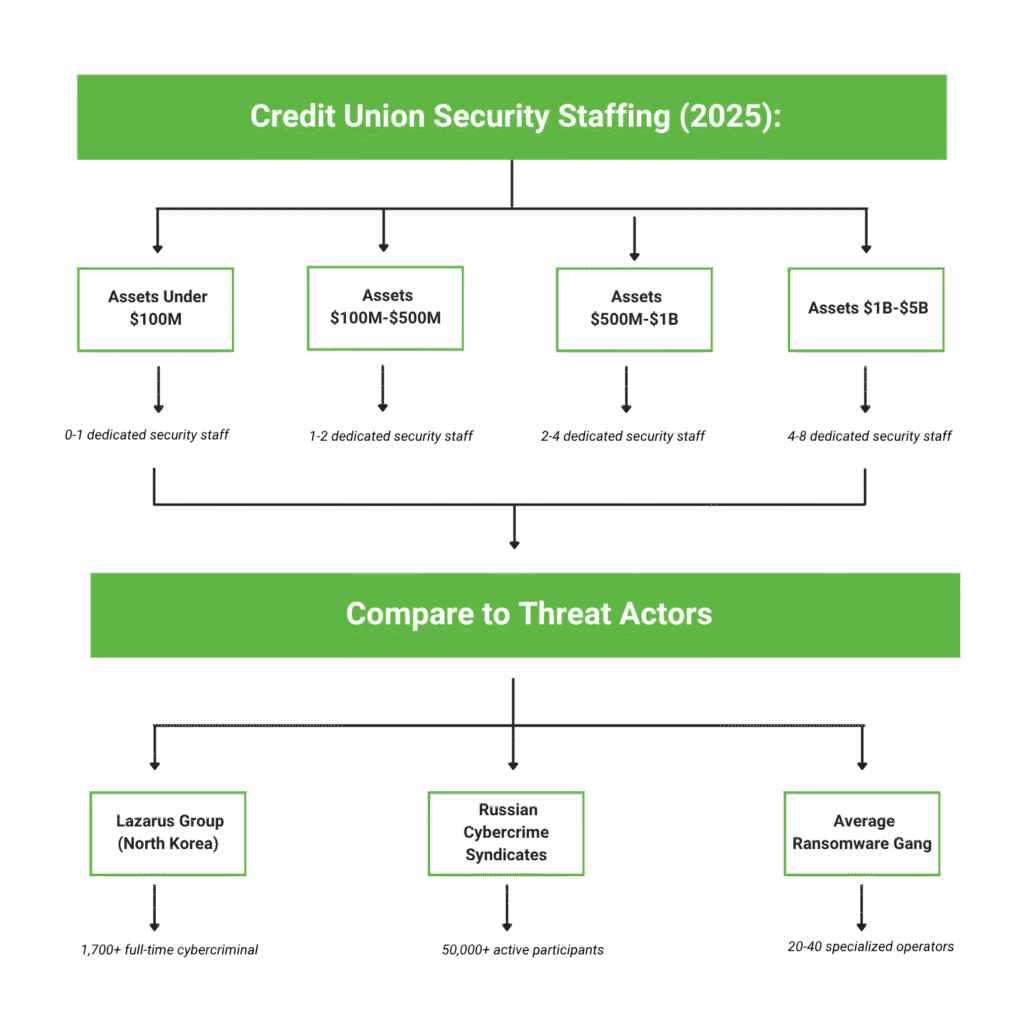

This asymmetry defines modern cyber warfare. Credit unions are defending against nation-state-grade threats with skeleton teams.

Most small credit unions simply cannot sustain this. Shared CUSO services offer limited compliance support, not real-time protection.

Average Annual Compliance Cost ($500M CU): $470K–$600K. 30–40% of IT time spent on audits.

Only 23% of credit unions under $1B are on track. Non-compliance risks card brand penalties, reputational damage, and member churn.

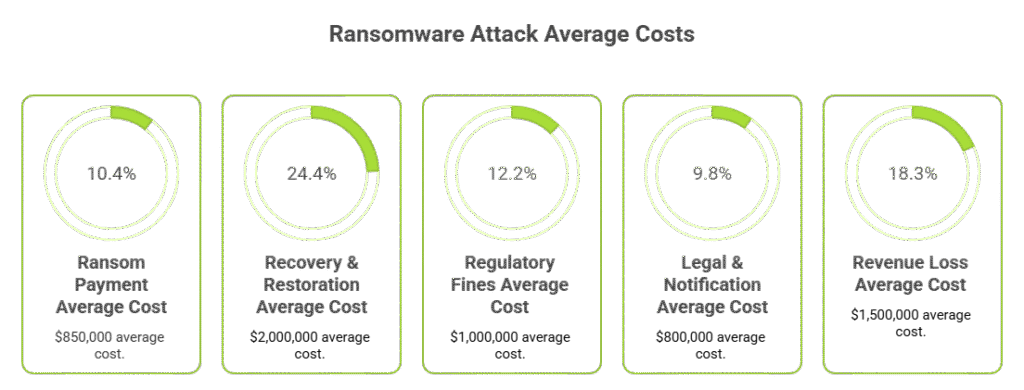

| Cost Component | Average Cost ($) |

| Ransom Payment | 850,000 |

| Recovery & Restoration | 2,000,000 |

| Regulatory Fines | 1,000,000 |

| Legal & Notification | 800,000 |

| Revenue Loss | 1,500,000 |

| Total | ~8.2M |

Recovery Time: 90–180 days | Member Attrition: 15–25%

Case Study: 2024 Community Bank Consortium breach — 15 CUs, $12M losses, 180K accounts compromised, 223-day dwell time.

Seceon’s aiSIEM™, aiXDR-PMax™, and aiCompliance CMX360™ platforms revolutionize security for credit unions by consolidating fragmented tools into one intelligent, AI-driven ecosystem.

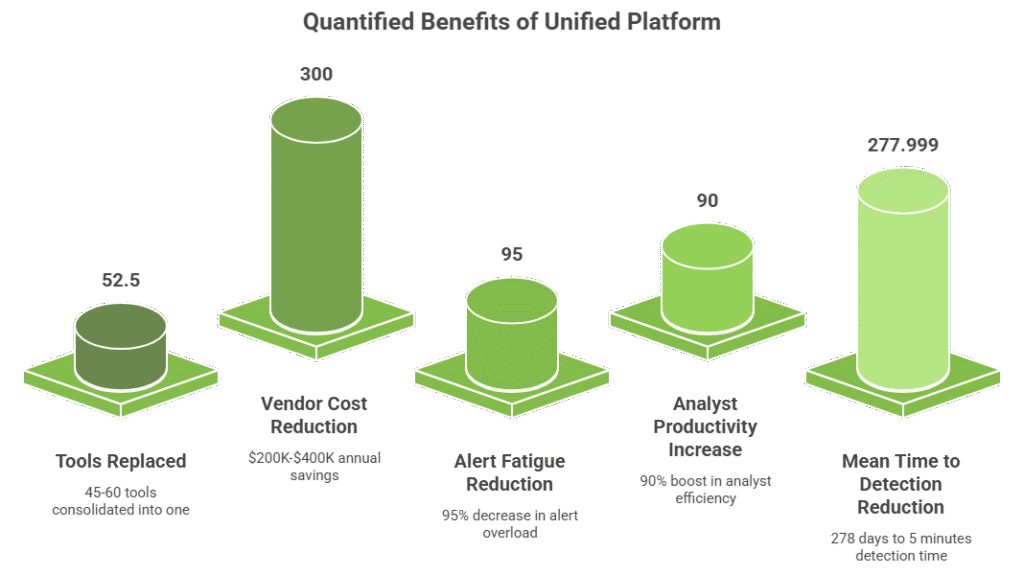

Before Seceon: 60 tools, 15 consoles, 10,000+ alerts/day, 95% false positives.

After Seceon: 1 AI-driven platform, <50 alerts/day, 5-minute detection.

Community Credit Union ($750M assets): – Tools: 52 → 1 – Annual Security Spend: $850K → $375K – Alerts: 8,500/day → 35/day – PCI DSS v4.0 compliance: 96% in 6 months

Seceon’s AI acts as a force multiplier for small teams.

Result: 1–2 staff can perform the duties of an 8–10 analyst team.

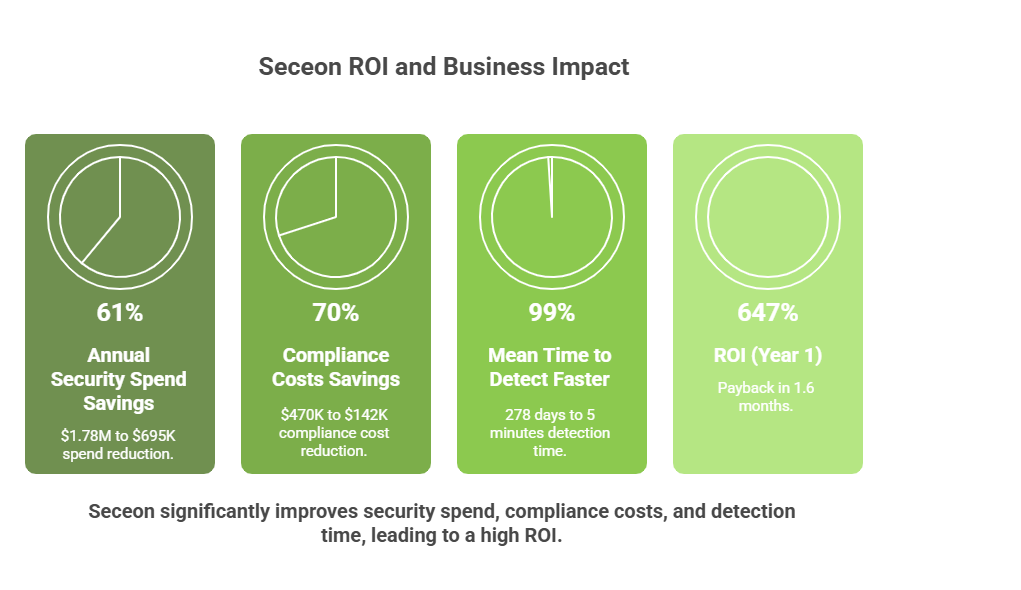

Cost Model: – Traditional SOC: $1.18M/year (5 staff) – Seceon AI SOC: $695K/year (2 staff) – Savings: $482K/year | 41% cost reduction

With SERA AI™, credit unions can operate complex SOC functions through English queries: – “Show me all suspicious transactions from last 7 days.” – “Are we PCI DSS v4.0 ready?” – “What’s our biggest risk right now?”

Seceon automates 90–100% of compliance evidence and validation across multiple frameworks (PCI DSS, GLBA, FFIEC, NCUA).

| Requirement | Manual Hours | Seceon Automated Hours |

| 1.3.1 Segmentation | 80 | 2 |

| 8.4.2 MFA | 40 | 0.5 |

| 10.2 Logging | 60 | 0.25 |

| 11.3.1.2 Scanning | 100 | 5 |

Result: 280 → 8 hours/quarter (97% time reduction)

Audit Scenario: Seceon generates full PCI DSS evidence packages in minutes, leading examiners to note best-in-class compliance efficiency.

Seceon’s predictive models detect and neutralize attacks in seconds, preventing ransomware, insider threats, and wire fraud.

1. Wire Fraud Prevention: AI blocks spoofed CEO wire transfer ($485K saved).

2. ATM Malware: IoT anomaly detection halts jackpotting in 90 seconds.

3. Insider Threat: Former employee credentials detected and revoked instantly.

Result: Zero data loss, zero downtime, zero ransom.

| Metric | Traditional | Seceon | Improvement |

| Annual Security Spend | $1.78M | $695K | 61% Savings |

| Compliance Costs | $470K | $142K | 70% Savings |

| Mean Time to Detect | 278 Days | 5 Minutes | 99% Faster |

| ROI (Year 1) | – | 647% | Payback: 1.6 Months |

Non-Compliance Consequences: – $5K–$100K monthly fines – Loss of card processing – Regulatory scrutiny and reputation loss

Seceon Fast-Track Program: – 30 Days: 85%+ compliance – 60 Days: 95%+ – 90 Days: Full audit readiness

Credit unions must modernize their cybersecurity posture immediately. The Seceon Platform provides: – Unified threat detection and response – AI-driven automation of SOC functions – Continuous compliance validation – 50–70% cost savings

Recommended Actions: 1. Schedule Seceon PCI DSS readiness assessment. 2. Quantify current tool costs and breach exposure. 3. Present Seceon ROI case to board. 4. Begin 30-day deployment plan.

The credit union cybersecurity landscape is entering a period of existential risk. Rising compliance requirements, staffing shortages, and escalating threats demand a radical transformation. Seceon’s AI-driven approach delivers the visibility, automation, and compliance control needed to safeguard member trust, institutional resilience, and long-term viability.

With measurable ROI, immediate compliance uplift, and predictive threat prevention, Seceon represents not just a tool — but a strategic shield for the modern credit union.

1. NCUA Cybersecurity Guidelines 2024–2025

2. PCI Security Standards Council: PCI DSS v4.0 Requirements

3. FFIEC Cybersecurity Assessment Tool (CAT)

4. Verizon Data Breach Investigations Report 2024

5. IBM Cost of a Data Breach Report 2024

6. Seceon Internal Case Studies (2023–2025)

7. Community Credit Union AI SOC Deployment Report (2024)

8. Financial Services ISAC Threat Landscape Review Q3 2024