U.S. Private Equity firms sit at the center of some of the most valuable economic activity in the world. They manage vast pools of capital, guide strategic acquisitions, and oversee diverse portfolios that span industries such as healthcare, manufacturing, technology, and financial services.

This position also places them squarely in the crosshairs of modern cyber adversaries.

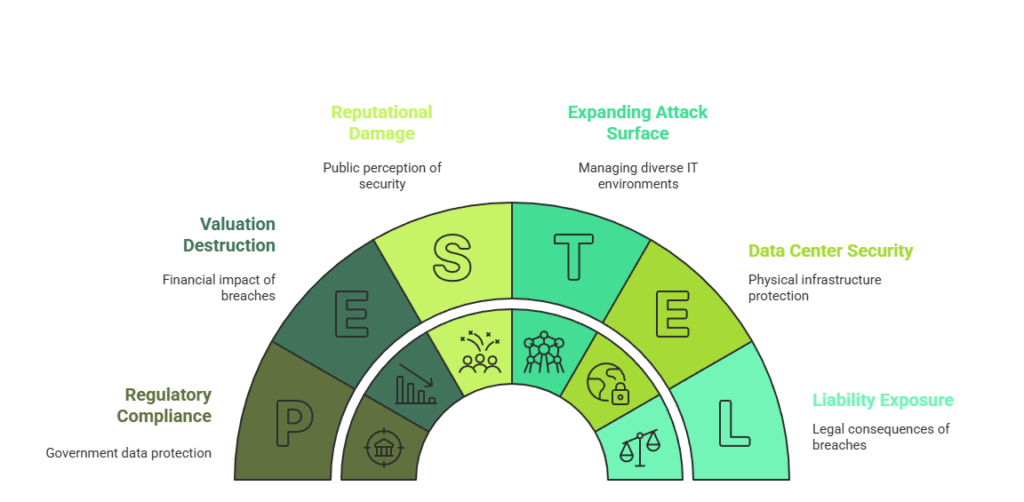

In 2024-2025, the cybersecurity challenge for Private Equity is defined by a dual-threat reality. PE firms must protect their own high-value operations while simultaneously managing the aggregated cyber risk of dozens of portfolio companies, each with its own technology stack, security maturity, and exposure.

This blog examines the evolving threat landscape facing U.S. Private Equity firms and explains why a unified, overlay-based security strategy is essential.

Private Equity firms operate in a rarefied, high-risk environment. At the firm level, they hold highly sensitive non-public information, including deal strategies, unreleased financials, investor data, and intellectual property tied to acquisitions.

At the portfolio level, they inherit the cyber risk of every company they acquire.

A breach at the PE firm itself is catastrophic.

A breach at a major portfolio company is valuation-destroying.

The challenge is compounded by scale. A single PE firm may manage 20, 30, or even 50 portfolio companies, each operating in different sectors and running different IT environments. This creates a sprawling attack surface that traditional enterprise security models were never designed to manage.

Private Equity firms are prime targets for highly tailored Business Email Compromise attacks.

The attack model:

Adversaries conduct detailed reconnaissance to understand deal timelines, decision-makers, and external partners such as law firms and banks. They strike just before a capital call or deal closing, impersonating a senior partner or CFO to redirect massive wire transfers.

The impact:

Losses are often in the millions and frequently unrecoverable, with immediate financial and reputational damage.

From an attacker’s perspective, a PE portfolio is a supply chain of opportunity.

The risk:

Many portfolio companies are acquired because they are under-managed or distressed, which often means low cybersecurity maturity. An attacker compromises a weaker portfolio company and then leverages trusted relationships to move laterally to the PE firm itself or to other, higher-value portfolio companies.

This aggregation effect dramatically amplifies risk.

Ransomware has become a strategic tool in the M&A process.

The timing:

Attackers deliberately launch ransomware campaigns during due diligence or just before an exit or sale.

The consequence:

Encrypting systems at a critical moment can derail a deal, force a downward valuation, or pressure the PE firm into paying an exorbitant ransom to protect the investment thesis.

Despite managing billions of dollars in assets, most PE firms operate with very lean internal IT teams and often without a dedicated CISO.

The challenge:

A small team cannot realistically monitor dozens of disparate security stacks across a diverse portfolio. Visibility gaps are inevitable, leading to reactive or hope-based risk management rather than informed oversight.

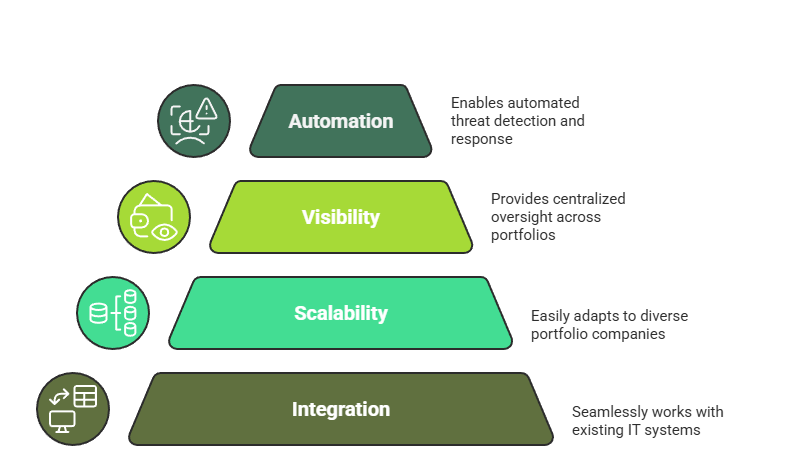

Private Equity firms cannot mandate that every portfolio company rip and replace their existing IT and security infrastructure. Doing so is costly, disruptive, and slow.

What PE firms need instead is an overlay security model, one that:

This is where a unified platform approach becomes critical.

Seceon’s Unified Platform (aiSIEM, aiXDR, and SOAR) aligns directly with the operational realities of Private Equity by delivering rapid deployment, vendor-agnostic visibility, and AI-driven threat detection across complex portfolios.

Traditional email security tools struggle to detect BEC attacks that use legitimate credentials.

Seceon advantage:

User and Entity Behavior Analytics (UEBA) establishes baselines for partners, executives, and finance teams. If a senior partner suddenly logs in from an unusual geography and attempts to initiate wire transfers during a sensitive deal window, Seceon flags the anomaly immediately, preventing financial loss.

PE firms need a single view of risk across dozens of portfolio companies.

Seceon advantage:

As a vendor-agnostic XDR platform, Seceon ingests logs and telemetry from any environment, cloud, on-prem, or hybrid. This provides centralized portfolio-wide visibility without forcing portfolio companies to change their existing technology stacks.

Cyber risk assessments during due diligence must happen fast.

Seceon advantage:

Seceon can be deployed quickly into target environments, often within hours or days. AI-driven analytics establish behavioral baselines and surface active threats or latent risks early, providing actionable intelligence that can influence deal terms, valuation, or go-no-go decisions.

Small internal teams cannot operate 24/7 security operations across a massive portfolio.

Seceon advantage:

AI and machine learning correlate millions of events into a small number of high-confidence alerts. Integrated SOAR enables automated actions, such as blocking malicious IPs or isolating compromised systems across multiple portfolio companies simultaneously, allowing lean teams or MSSP partners to operate at scale.

| Private Equity Challenge | Seceon Unified Platform Relevance |

| High-value BEC and wire fraud | UEBA detects anomalous behavior during critical deal windows |

| Lack of visibility across PortCos | Vendor-agnostic XDR overlay provides a single pane of glass |

| Cyber risk during due diligence | Rapid AI deployment surfaces risks early |

| Ransomware threatening valuations | SOAR enables automated, sub-second containment |

| Lean teams managing large portfolios | AI-driven correlation acts as a force multiplier |

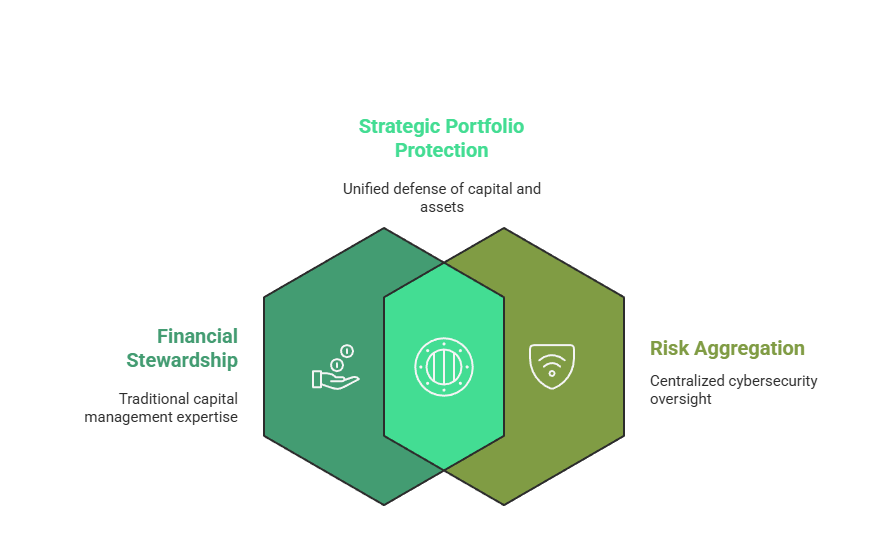

Private Equity firms are no longer just financial stewards. They are risk aggregators.

As cyber threats increasingly target deal flow, valuations, and portfolio operations, security must evolve into a centralized, intelligence-driven capability that spans the entire investment lifecycle.

A unified overlay platform enables PE firms to protect capital, preserve deal value, and gain real-time insight into portfolio risk without disrupting operations.

With unified visibility, behavioral intelligence, and automated response, Private Equity firms can manage cybersecurity as strategically as they manage capital.